Abolish Ohio property taxes?

You might have heard that there’s a group of people collecting signatures to end (abolish) property taxes in Ohio.

Today, Governor Mike DeWine (a Republican) tried to explain how bad that would be for our state.

If we abolish property taxes, Ohio would need to find other ways to bring in revenue for water departments, sewer departments, street repair, and schools — so other taxes would shoot way up.

“Sales tax could go up to 17, 18, 19, 20%…on products that you buy. So it would be absolutely devastating,” Governor DeWine said.

”DeWine also warned that policymakers could be forced to consider increasing income taxes to find new revenue…”

I rarely agree with the governor on anything, but he’s absolutely right about this.

Sales taxes hurt poor and working class families the most.

Think about it. Ohio places a sales tax on “tangible goods” that everyone has to buy — like clothes, school supplies, and cleaning supplies. We all need those things, but rich people only have to use a tiny percentage of their paycheck to buy them. Poor people are forced to use a big chunk of their paycheck to pay for those same items.

And it’s not just about sales and income taxes increasing. Without property taxes, pretty much every program and service in your community would be in danger.

Here are some examples:

FIRST RESPONDERS — A quarter of Ohio counties use property tax levies to fund police and fire departments and/or 911. Without property taxes, local emergency services would be forced to make major cuts.

In small towns and rural areas, police and fire departments could shut down entirely. Those communities would be forced to contract with departments in neighboring areas, so the response time would be much longer when you called 911 in an emergency.

SENIOR SERVICES — 74 of Ohio’s 88 counties use property tax levies to pay for senior services. No property taxes = massive cuts to senior services in these counties. It’s that simple.

CHILDREN SERVICES — 80% of Ohio kids live in areas where property tax levies help pay for children services. Children services handle tens of thousands of reports of child abuse, neglect, and other concerns every year. The painful truth: abolishing property taxes will hurt thousands of Ohio kids.

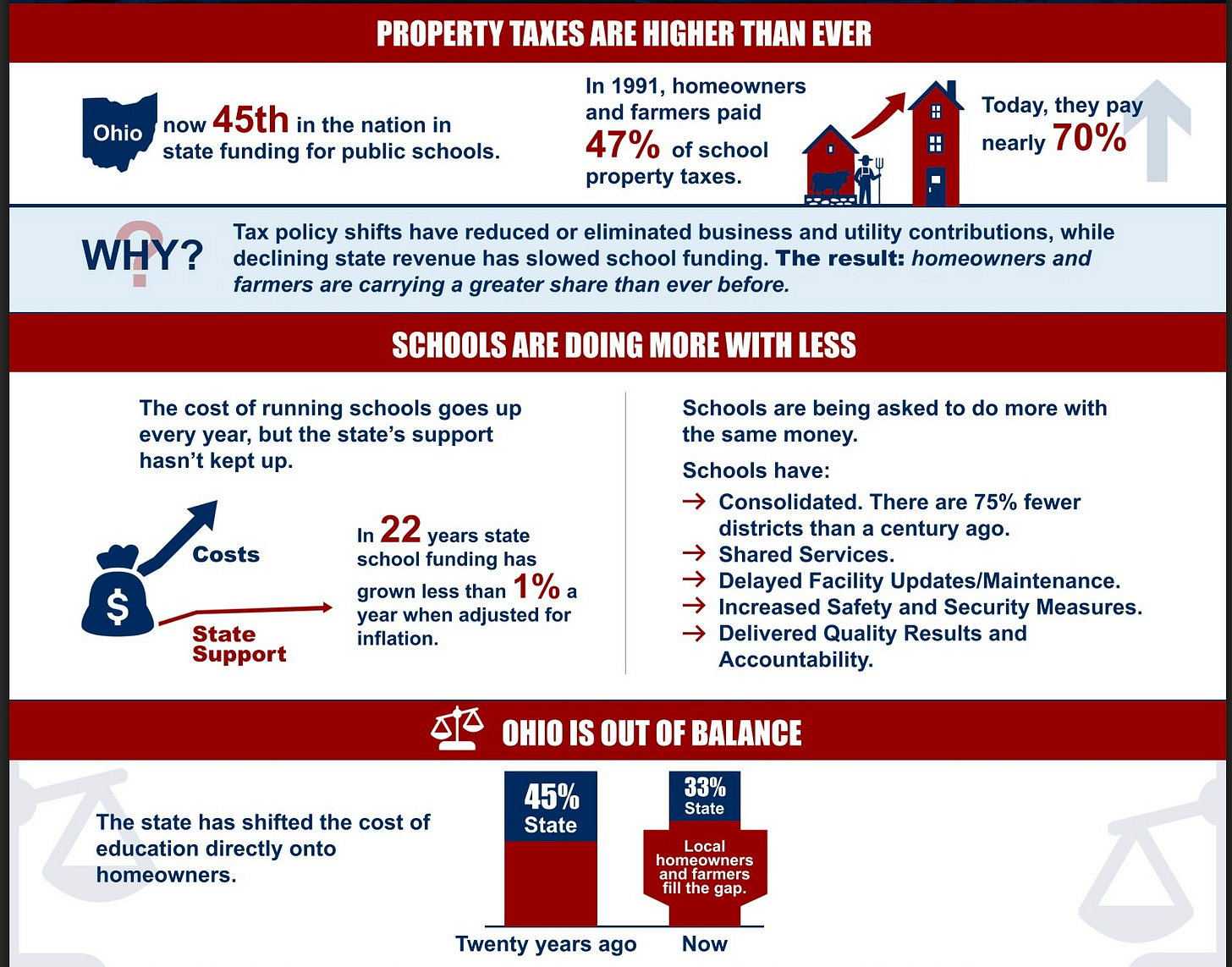

SCHOOLS — Ohio is already 45th in the nation in state share of funding for public schools. That means Ohio makes its schools rely more heavily on alternate funding sources (like property taxes) than nearly every other state. Without property taxes, school districts would be forced to make drastic, desperate decisions. Everything would be on the table, including shutting down and combining schools, ending classes and programs, massive staff layoffs, and much more.

If Ohio politicians were willing to tax millionaires, billionaires, and corporations properly, there might be a way to discuss ending (or at least greatly decreasing) property taxes….(Though if Ohio taxed millionaires, billionaires, and corporations properly, property taxes would already be much lower).

Sadly, that’s highly unlikely to happen while a Republican supermajority controls the Statehouse.

So for now, if someone tries to get you to sign a petition to abolish property taxes in Ohio, tell them HELL NO.

If we DECLINE TO SIGN, we can defend our local communities and protect our most vulnerable neighbors.

Next step? We’ll need to unrig Ohio and elect leaders who care about families instead of their wealthy donors.

There is no foresight in even considering this! It’s a stupid hook to rein in uninformed voters. I suggest we educate the petition holders!😉What are they thinking?

Who is DEFUNDING police, fire, water, education, streets and sanitation?

REPUBLICONS!

If these public “shared cost'“ services are privatized be prepared for skyrocketing prices, lower quality services, zero citizen accountability and zero transparency.

Keep the public sector!